What is a SWOT analysis? Plus a SWOT analysis template

4-minute read

A SWOT analysis can help you to determine the direction of your business, either at the business plan stage or at a later date.

The purpose of a SWOT analysis is to help you make informed decisions about your business – such as where to focus your efforts, how to utilise your strengths, and find areas of improvement.

In this guide we explain the benefits of a business SWOT analysis – as well as how to do one (with help from a free downloadable SWOT analysis template).

What is a SWOT analysis?

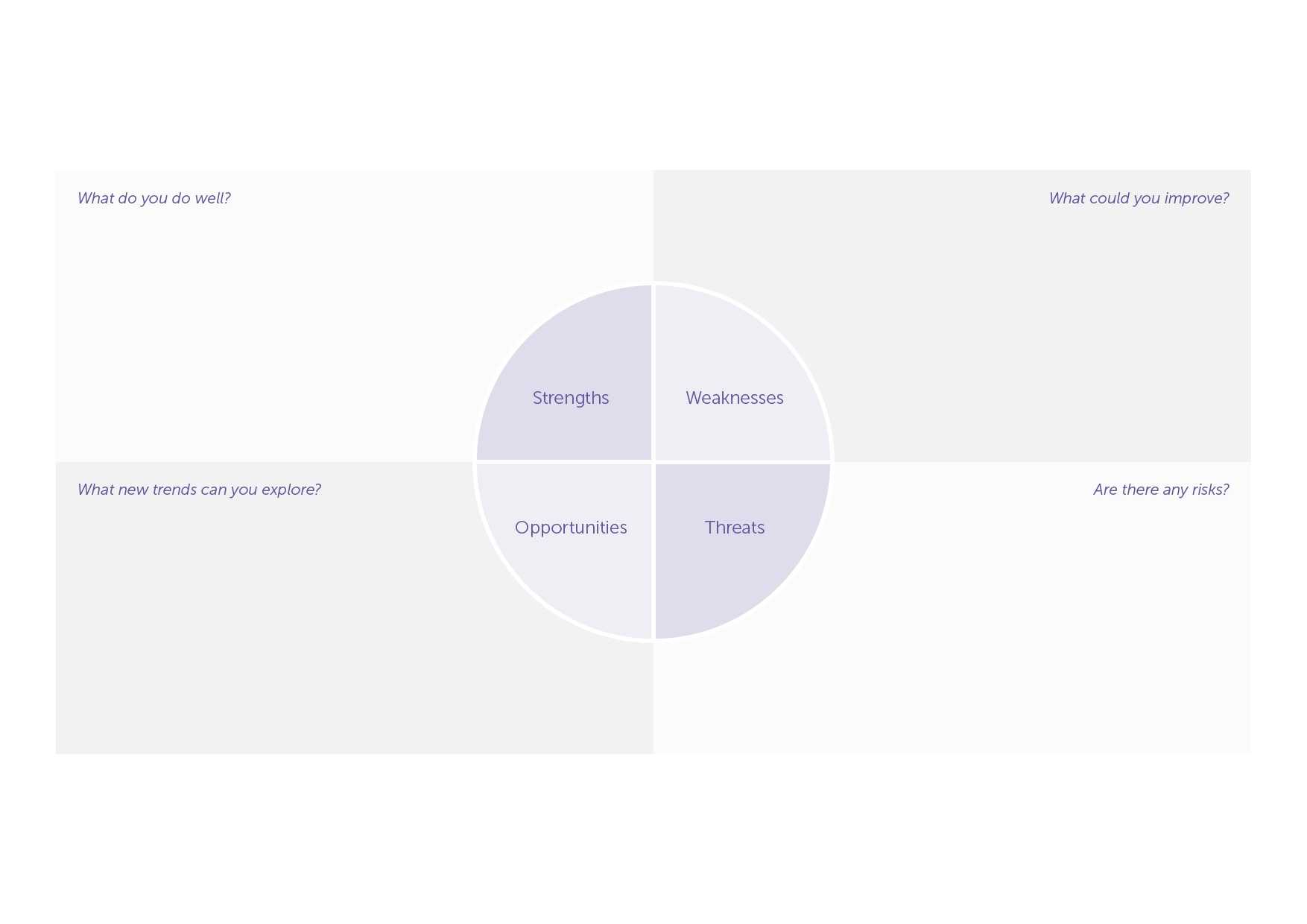

A SWOT analysis is a technique to help you gain a better strategic understanding of your business. The acronym stands for:

- Strengths – what you do well

- Weaknesses – what you could improve on

- Opportunities – new trends to explore or external opportunities to leverage

- Threats – any potential risks

Completing a SWOT analysis gives you a better handle on all of these factors and the ways in which they could impact your business.

SWOT analysis is often part of writing a business plan. You can also use it to guide your marketing plan, financial strategy, or to understand a specific project.

A SWOT analysis template

Here we’ll explain more about how to do a SWOT analysis. Why not download your free SWOT analysis template, which includes a selection of designed and editable SWOT analysis examples? You can fill it in as you read through our step-by-step guide.

DownloadAdvantages and disadvantages of a SWOT analysis

For new businesses, a SWOT analysis can give you a simple framework to analyse your business idea and get it off the ground. While a SWOT analysis of a company that’s already up and running can offer an overview of performance and growth.

Advantages

- simple to create

- informs strategic planning

- helps you evaluate existing products or decide new ones

- identifies risks and opportunities

- explores market changes

- provides a framework for presenting to stakeholders

Disadvantages

- process can be overly simplistic

- external factors (threats and opportunities) are outside your control

- difficult to be objective – for example, threats may be based on perception rather than data

- little space for in-depth analysis or commentary

- it’s just one component, it needs to accompany a wider business plan

- there’s no hierarchy so can be hard to know what to focus on first

How to do a SWOT analysis

Before you start, gather as many different perspectives as possible. Speaking to your suppliers, customers, and employees (if you have any) can help you evaluate your business from all angles.

It’s also important to use data in your analysis, so collect any useful information such as reviews and customer feedback as well as financial reports and growth trends.

Use one of the editable templates in our SWOT analysis PDF download above and write down the strengths, weaknesses, opportunities, and threats of your business. The following sections outline key questions to explore as you go through this process.

You can use this process to analyse your key competitors as well.

Strengths

First, look at your strengths and determine your unique selling point as a business. What is it that makes you stand out from the crowd? Consider your assets – this might include your knowledge, any existing intellectual property, business connections, qualifications, and more.

Weaknesses

Here, you need to concentrate on areas of your business that are holding you back or need developing so you can be successful. Think about factors that are within your control – what can you improve internally to make sure that you’re competitive? Do you need more staff, better technology, or new skills?

Opportunities

Next, consider what external factors could benefit your business. For example, is your market growing? Are there new trends or emerging technologies that you can explore to make yourself more competitive or profitable? Think about what your competitors are doing and how you can get ahead.

Threats

You may not be able to control external risks and threats, but being aware of them can help you prepare your business for potential challenges. For example, what if one of your competitors takes a bigger share of the market? What if demand starts to shrink? Have you considered environmental or consumer factors that might change suddenly and what that might mean for your business?

SWOT analysis example

If you need a little more inspiration, here’s a SWOT analysis example for a freelance makeup artist:

Strengths

- experience and education: six years of experience – including formal training and salon work before going freelance, which establishes reputation and skill

- strong social media presence: strong engagement on TikTok and Instagram through posting before/after videos, works as free marketing and attracts clients

- niche market: as the only makeup artist in town there’s less direct competition

- mobile service: travelling to clients is often more convenient, especially in a smaller community

Weaknesses

- limited geographic reach: working in a small town might restrict the potential client base

- lack of physical premises: not having a salon can be a disadvantage for clients who prefer that setting or for larger group bookings

- potential for burnout: travelling to clients and working alone can be tiring and isolating

Opportunities

- expansion potential: working near a larger town could offer a broader client base and opportunities for networking

- salon ownership: with the ultimate goal of having a physical premises, there’s a clear path for growth – as well as establishing a more permanent brand presence

- diversification: potential to offer additional services (such as makeup lessons, special occasion packages, product sales) to increase revenue

- collaborations: opportunity to partner with photographers, hairstylists, or event planners to expand reach and offer bundled services

Threats

- potential competition: while there are currently no other makeup artists in the area, others could move in or start offering similar services

- economic factors: the economic climate can impact client spending on beauty services

- changing trends: the beauty industry evolves quickly, so staying updated on techniques and styles is essential

- market saturation: nearby larger cities, which are home to more established makeup artists, could make it harder to break into that market

Personal SWOT analysis

It’s also possible to do SWOT analysis of a person. Using the same framework for self SWOT analysis can help you identify your skills and areas for growth.

If you’re a new business owner, you might find this helpful to make sure you’re using your strengths to your advantage and that your business and personal goals are aligned.

Personal SWOT analysis examples:

Strengths:

- what personal strengths do you have?

- do you have the relevant knowledge?

Weaknesses:

- have you built up a cash reserve to support your business getting up and running?

- are there any gaps in your skills?

Opportunities:

- is there any new technology you can use – for example an invoicing app to help with accounting?

- do you have existing business contacts in your network?

Threats:

- are your personal commitments distracting you from your business?

- what’s the current economic situation?

So doing a SWOT analysis, for either your small business or yourself, can help you understand where to direct your efforts as you plan for future growth. But it must form part of a larger strategy and ongoing analysis.

How has SWOT analysis informed your business plan? Let us know in the comments.

Useful guides for small business owners

Ready to set up your cover?

As one of the UK's biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?

Start your quote

Written by

Rosanna Parrish

Rosanna Parrish is a Copywriter at Simply Business specialising in side hustles – as well as all things freelance, social media, and ecommerce. She’s been writing professionally for nine years. Starting her career in health insurance, she also worked in education marketing before returning to the insurance world.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.